Institutional

grade on-chain DeFi data

for investment professionals

FLUIDEFI is a DeFi data layer infrastructure with 2+ billion data

points

that enables investors to create DeFi investment products and systems.

Launch your DeFi investment products in days, not months.

Impermanent Loss VS. Holding (24H)

Insights on holding assets (traditional price-based trading strategy) versus using

those same assets to provide liquidity (generating a fee when other investors trade those assets).

those same assets to provide liquidity (generating a fee when other investors trade those assets).

| Liquidity Pool | Liquidity | Fees Generated | HODL Return | Imp. Loss | Period Return |

|---|---|---|---|---|---|

| USDC-WETH | $30,841,808.083 | 342.758% | 1.192% | -0.00712% | 343.943% |

| NMR-WETH | $220,642.056 | 2.844% | 40.712% | -1.587% | 69.43% |

| WETH-✺RUG | $404,678.95 | 0.4437% | 20.314% | -1.152% | 30.353% |

| CHEQ-USDT | $245,054.375 | 0.2335% | 23.712% | -1.901% | 25.891% |

| ZEPHYR-WETH | $22,239.881 | 3.624% | 24.424% | -2.374% | 25.789% |

| DAI-WETH | $15,278,079.254 | 23.73% | 1.239% | -0.006975% | 24.963% |

| VVS-USDC | $11,729.079 | 4.156% | 20.694% | -1.446% | 23.063% |

| CRO-WETH | $31,330.138 | 1.156% | 18.389% | -0.9136% | 18.46% |

| LPT-WETH | $54,382.301 | 1.926% | 10.009% | -0.3568% | 10.899% |

| SYRUP-WETH | $2,421,416.372 | 0.4882% | 7.61% | -0.1053% | 10.279% |

Trending Pools (24H)

Trending liquidity pools

(Multiple protocols).

(Multiple protocols).

| Pair | Liquidity | Period Return |

|---|---|---|

| USDC-WETH | 30,841,808.083 | 343.943% |

| WETH-GOAT | 26,087.096 | 161.754% |

| SFROG-WETH | 22,892.382 | 123.083% |

| GPT4-WETH | 34,174.248 | 90.614% |

| TOTO-WETH | 175,689.619 | 87.545% |

| AlphaGo-WETH | 33,485.152 | 84.755% |

| Grok-WETH | 30,699.244 | 79.199% |

| WETH-OPM | 148,680.298 | 77.487% |

| ETHZ-WETH | 93,913.064 | 73.42% |

| WETH-KIKO | 57,239.313 | 72.617% |

Trusted by the best

Build your own DeFi investment products & systems with 100% accurate and reliable DeFi data.

The majority of DeFi data providers lack accuracy, reliability, and compliance. FLUIDEFI's quantum-safe, bank-grade, non-custodial, patent-pending technology provides 100% accurate on-chain DeFi data with up to 105 decimal places of precision.

Simulate DeFi investment strategies using curated on-chain data & robust APIs.

Using FLUIDEFI's simulation environment, curated data, and robust APIs, investors are able to backtest DeFi investment strategies using metrics computed from on-chain transaction data and gain a greater edge. FLUIDEFI calculates 75+ unique DeFi data points and measures against volume as well as price.

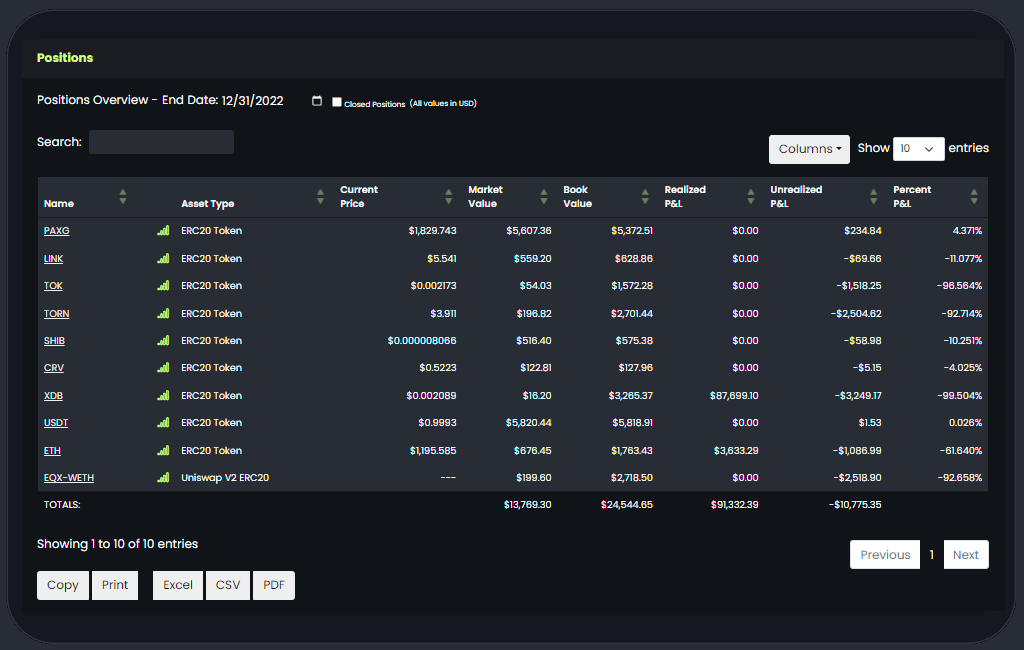

Simplified auditable accounting & tax reporting for DeFi on-chain data.

Simply add wallet addresses (no keys required) to see detailed reports of profit, loss, fees earned, and more, as of any date. Transaction level-granularity with traceability back to the blockchain allows auditors to verify every accounting entry.